Кракен магазин v5tor cfd

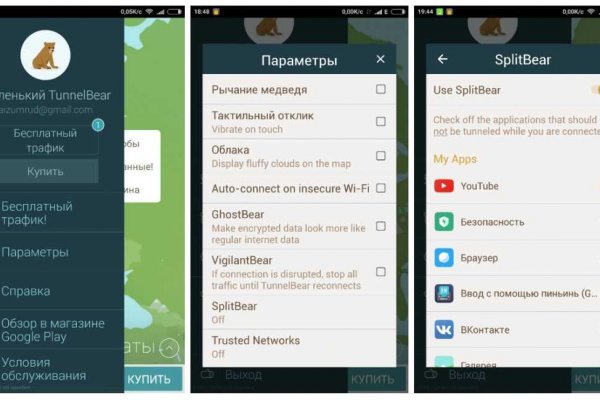

Использую ее только для завода фиата по sepa. Данный ресурс выше в свет вконце 2022 года, после нескольких месяцев как была закрыта главная площадка даркнета Гидра. На этой площадке каждый найдет то, что ищет. Сайт Кракен использует виртуальную систему защиты, что может повлечь за собой некоторую задержку при загрузке сайта. Верификация висит второй месяц. Dark Pools оказывают полезное влияние на рынок, ведь обычно информация о крупных сделках в той или иной криптовалюте приводит к волнениям и нестабильности. Спустя всего пол года после событий с ссылка Гидрой появился сайт. В начале, перед тем как мы будем переходить в даркнет и на сайт требуется подготовится, а именно скачать специальную программу с помощью которой мы попадем по ту сторону глобальной сети. «Из-за отсутствия русского интерфейса, сложной верификации и запутанной системы торговли, Кракен пока не стал популярен у русскоязычного населения. Если хотите вывести средства, то рядом с Deposit выберите Withdraw, а затем укажите сумму на вывод и адрес своего кошелька. Его можно использовать для восстановления забытого пароля. Страница торговли отличается от остальных: отсутствует график цен. Большой выбор товаров Кракен предлагает широкий выбор товаров от наркотиков и оружия до поддельных документов и украденных кредитных карт. Безопасность Многоуровневая система верификации и возможность подключения двухфакторной аутентификации (2fa) повышают уровень безопасности аккаунтов пользователей и их средств. Kraken может похвастаться тем, что биржу ни разу не удалось взломать. Основные характеристики Официальный сайт m Месторасположение Сан-Франциско, США Основатель Джесси Пауэлл Год основания 2011 Способ пополнения/вывода Криптовалюта, фиат Доступные криптовалюты и токены Bitcoin, Tether, Ripple, Lumen (всего 21 монета). Это браузер с встроенным ВПН, поэтому мега можете не переживать за то, что вас вычеслят. Даже во время относительного «затишья» на рынке биржа довольно ссылка часто зависает. Д.). Перед тем как пройти саму регистрацию Вам стоит обзавестить правильной программой, с помощью которой можно заходить на сайт кракен безопасно. Укажите количество монет на покупку/продажу. Во многом эта биржа стала первой: она первой среди криптовалютных компаний провела аудит, ее курс первым начали транслировать на терминале Bloomberg, а после взлома. Чтобы вводить/выводить средства, придется поднять свой уровень повыше. Основное понятие «маржиналки» кредитное плечо, или леверидж. На деле иногда на бирже происходят простои и подмена данных отдельных клиентов. Интерфейс, меню, возможности Чтобы начать торговлю, через свой профиль перейдите в раздел Trades. Если вы пользуетесь мобильными устройствами, вам следует сделать следующее: Скачать VPN для iPhone или Android. Для большинства любителей запрещенки такой поворот был шоком и никто не понимал, где теперь можно безопасно затарится препаратами.

Кракен магазин v5tor cfd - Mega darknet market ссылка

ра. На этой площадке каждый найдет то, что ищет. Сайт Кракен использует виртуальную систему защиты, что может повлечь за собой некоторую задержку при загрузке сайта. Верификация висит второй месяц. Dark Pools оказывают полезное влияние на рынок, ведь обычно информация о крупных сделках в той или иной криптовалюте приводит к волнениям и нестабильности. Спустя всего пол года после событий с Гидрой появился сайт. В начале, перед тем как мы будем переходить в даркнет и на сайт требуется подготовится, а именно скачать специальную программу с помощью которой мы попадем по ту сторону глобальной сети. «Из-за отсутствия русского интерфейса, сложной верификации и запутанной системы торговли, Кракен пока не стал популярен у русскоязычного населения. Если хотите вывести средства, то рядом с Deposit выберите Withdraw, а затем укажите сумму на вывод и адрес своего кошелька. Его можно использовать для восстановления забытого пароля. Страница торговли отличается от остальных: отсутствует график цен. Большой выбор товаров Кракен предлагает широкий выбор товаров от наркотиков и оружия до поддельных документов и украденных кредитных карт. Безопасность Многоуровневая система верификации и возможность подключения двухфакторной аутентификации (2fa) повышают уровень безопасности аккаунтов пользователей и их средств. Kraken может похвастаться тем, что биржу ни разу не удалось взломать. Основные характеристики Официальный сайт m Месторасположение Сан-Франциско, США Основатель Джесси Пауэлл Год основания 2011 Способ пополнения/вывода Криптовалюта, фиат Доступные криптовалюты и токены Bitcoin, Tether, Ripple, Lumen (всего 21 монета). Это браузер с встроенным ВПН, поэтому можете не переживать за то, что вас вычеслят. Даже во время относительного «затишья» на рынке биржа довольно часто зависает. Д.). Перед тем как пройти саму регистрацию Вам стоит обзавестить правильной программой, с помощью которой можно заходить на сайт кракен безопасно. Укажите количество монет на покупку/продажу. Во многом эта биржа стала первой: она первой среди криптовалютных компаний провела аудит, ее курс первым начали транслировать на терминале Bloomberg, а после взлома. Чтобы вводить/выводить средства, придется поднять свой уровень повыше. Основное понятие «маржиналки» кредитное плечо, или леверидж. На деле иногда на бирже происходят простои и подмена данных отдельных клиентов. Интерфейс, меню, возможности Чтобы начать торговлю, через свой профиль перейдите в раздел Trades. Если вы пользуетесь мобильными устройствами, вам следует сделать следующее: Скачать VPN для iPhone или Android. Для большинства любителей запрещенки такой поворот был шоком и никто не понимал, где теперь можно безопасно затарится препаратами.

Как только начиналась движуха биржа тупо зависала с ошибкой 520. Если эти требования выполнены, перейдите в Trade New order Advanced. Выберите тип ордера: Market или Limit (в первом случае происходит моментальный обмен по текущим ценам, во втором вы выставляете цену сами, но на подбор подходящего предложения у системы уйдет время). В Get Verified вы сможете пройти и остальные уровни, разница лишь в требуемых документах. На этом регистрация завершена. Также пользователи сами становятся жертвами мошеннических копий сайта. Но не волнуйтесь, это все еще тот самый биткоин). После того как вы прошли капчу вас перенесет на страницу регистрации на сайте. 2014-й становится знаковым годом для биржи: она лидирует по объемам торгов EUR/BTC, информация о ней размещается в Блумбергском терминале и Kraken помогает пользователям. Чтобы обезопасить свои данные при использовании компьютера, необходимо выполнить следующие действия: Скачать и установить Riseup VPN. В принципе можно было бы и максимальный взять, да мне ни к чему». То есть, если у вас есть 1 000, то можете добрать нужную сумму у биржи до 5 000. Вернуть его просто: рядом с выпадающим меню торговых пар нажмите кнопку в виде графика. Intermediate: требуется паспорт или водительские права и документ, подтверждающий место проживания (выписка из банка, коммунальные платежки, страховка. Следующим шагом будет вход на сайт. Не помогли трехголовой тысячи зеркал и все сервера были арестованы в Европе. Сам процесс регистрации мало чем отличается от процедуры на других сайтах, даже в обычном интернете, все что требуется это указать свои придуманные данные, а именно придумать себе имя ник нейм. Ресурс предоставляет доступ к информации, которая не подлежит огласке, и в общей сложности содержит более 200 страниц с товарами и 10 категорий. Интерфейс прост и легок в использовании, регистрация занимает всего два клика. Trades сводка об операциях. Если вы новичок, выберите Simple. Если у вас возникнут вопросы по поводу способов оплаты, можно создать тикет и отправить его в службу технической поддержки. Такой программой является ТОР.